Frequently Asked Questions

Reporting method effective 2018: The Internal Revenue Service (IRS) requires colleges and universities to report "the total amount of payments received for qualified tuition and related expenses from all sources during the calendar year less any reimbursements or refunds" on a 1098-T. 1098-Ts must be issued in January of each year for the previous tax/calendar year. JCC reports payments that were received during the current calendar year for qualified tuition and related expenses.

- The responsibility for your individual tax circumstances rests with the taxpayer alone, and JCC cannot take any responsibility for your interpretation of this information. If you have questions or need further assistance, contact your tax advisor or refer to the Internal Revenue Service (IRS) Publication 970.

- JCC cannot provide tax advice.

- If you believe the reported information is incorrect, contact the Financial Aid & Billing Office.

What is a Form 1098-T and why do I need one? All eligible educational institutions must file a Form 1098-T to report information to the IRS for the amount billed to you by JCC over the course of the previous calendar year. The purpose of the 1098-T is to help you and/or your tax professional determine if you are eligible for an Education Tax Credit. Your 1098-T form may not provide all of the information you need to determine eligibility for tax credits and deductions. Eligibility for any tax benefit depends upon your individual facts and circumstances and the JCC cannot provide you with any tax advice.

Where can I obtain additional information about this form? You should refer to IRS tax form 8863 and Publication 970 when completing your forms. If you are experiencing difficulty completing the form, JCC urges you to contact your accountant, tax preparer, or the Internal Revenue Service regarding the application of this form to your taxes.

Is this form a bill? No, it is not a bill nor a request for payment.

Is this form a source of income that I must include on my tax forms? No, this form is a statement of the amount paid for qualifying tuition and related expenses during the current calendar year. However, while not an income reporting form, if scholarships and grants exceed qualified expenses, then this may be considered reportable income. You should consult your tax advisor to make this determination.

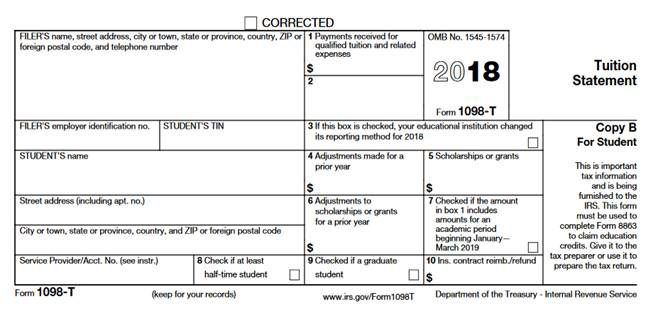

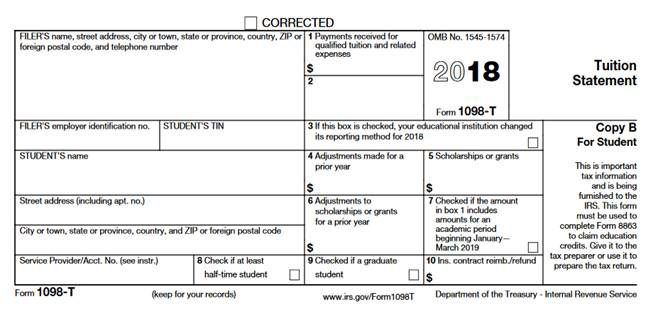

How is the amount determined? Following is a sample form and descriptions for boxes 1-10.

- Box 1: Payments received by JCC for qualified tuition and related expenses less refunds during the current year. Not all charges are qualifying.

- Box 2: Will be blank. Qualifying charges are detailed on your Banner account. The following categories of charges are included or not included in determining qualified tuition and related expenses:

- Included charges: Tuition, general college fees, special class fees, course/lab fees, technology fee, student activity fee

- Not included charges: Fines, health insurance premiums/health fee, credit by exam/prior learning credit fee, tuition installment plan fee, room and board charges, course related books and equipment, registration fees paid for non-credit courses, phys ed lab fee

- Box 3: Our reporting method did not change for reporting payments.

- Box 4: Adjustments made for a prior year are detailed on your Banner account.

- Box 5: Sum of all scholarships JCC administered and processed for the student’s account during the calendar year, including:

- Scholarships that pay for tuition (qualified scholarships)

- Housing, books, and other expenses (non-qualified scholarships)

- Tuition waivers and payments received from third parties that are applied to student accounts for educational expenses

- The amount of scholarships or grants for the calendar year may reduce the amount of the education credit you claim for the year.

- Box 6: Adjustments made to scholarships or grants reported on a prior year Form 1098-T in Box 4.

- Represents a reduction in scholarships or grants reported for a prior calendar year

- May affect the amount of any allowable tuition and fees deduction or education credit you may claim for the prior year

- Box 7: Will be checked if the amount reported in Box 1 includes tuition or qualified amounts paid by a student account in the current year for qualifying tuition or expenses for a semester beginning in the next calendar year. For example, a payment made in December of the current year for the upcoming Spring will be reported on your current 1098-T. Box 7 will be checked to indicate that this is the case.

- Box 8: Shows whether you are considered to be carrying at least one-half the normal full-time workload for your course of study at the reporting institution. If you are at least a half-time student for at least one academic period that begins during the year, you meet one of the requirements for the American opportunity credit. You do not have to meet the workload requirement to qualify for the lifetime learning credit.

- Box 9: Shows whether you are considered to be enrolled in a program leading to a graduate degree, graduate-level certificate, or other recognized graduate-level educational credential. This box will be blank.

- Box 10: Shows the total amount of reimbursements or refunds of qualified tuition and related expenses made by an insurer. This box will be blank.

I’m a parent. Can I have my student’s 1098-T form sent to me? Students must make all information requests. The student is responsible for providing information to other parties in accordance with FERPA (Family Education Right to Privacy Act).

Why is it that I don’t have any information on the Form 1098-T or I never received a Form 1098-T in the mail? JCC is not required to file Form 1098-T or furnish a statement for:

- If your billed amounts consisted of only non-credit courses, even if the student is otherwise enrolled in a degree program.

- International (foreign) students who are not U.S. residents for tax purposes (who have not been in the U.S. less than 5 years).

- Students classified as non-resident aliens.

- If you paid for your enrollment fees, but dropped all your classes and received a refund during that calendar year, then you would not receive a Form 1098-T.

- If your address on record is out-of-date, your Form 1098-T may have been returned.

Why do my records not match the tuition and fee payments reflected on my Form 1098-T? When reviewing your records, take into consideration actual registration dates in order to reconcile your records in the amounts on the form. The 1098-T form reflects payment and refunds made in the calendar year for qualifying tuition and expenses. The following expenses do not qualify as tuition and related expenses for community colleges: 1) Remote Registration Fee; 2) books; 3) parking permits; 4) housing.